Why do you need help?

The issue of consumer debt in the United States is indeed a significant and complex one, with many individuals facing challenges in managing their financial obligations. The staggering amount of consumer debt, which exceeds 14 trillion dollars, underscores the widespread impact of this issue on individuals and families across the country.

Many people find themselves trapped in a cycle of debt, struggling to break free from circumstances that seem insurmountable. As debts accumulate and financial burdens grow, individuals may experience a range of negative consequences that affect not only their own lives but also those of their families.

At the heart of this issue is a financial system that often prioritizes profit over the well-being of consumers. Credit lenders and banks may engage in practices that exploit the vulnerabilities of individuals, leading to situations where debt becomes overwhelming and difficult to escape. This is an important reason to maintain a credit monitoring service.

Some common practices include:

1. Predatory Lending: Some lenders target vulnerable individuals with high-interest loans or credit products, knowing that they may struggle to repay them. These loans can trap borrowers in a cycle of debt, with interest accruing faster than they can pay down the principal balance.

2. Hidden Fees and Penalties: Credit agreements often contain complex terms and conditions that may include hidden fees, penalties, or adjustable interest rates. These can catch consumers off guard and lead to unexpected increases in debt.

3. Aggressive Marketing Tactics: Banks and credit card companies may use aggressive marketing tactics to encourage consumers to take on more debt than they can afford. This can include pre-approved credit offers, promotional incentives, and targeted advertising campaigns.

4. Lack of Financial Education: Many consumers lack the financial literacy needed to make informed decisions about borrowing and managing debt. Without a solid understanding of interest rates, repayment terms, and credit scoring, they may fall prey to deceptive or misleading practices.

5. Limited Access to Affordable Credit: Some individuals, particularly those with lower incomes or poor credit histories, may have limited access to affordable credit options. This can force them to turn to high-cost alternatives, exacerbating their financial difficulties.

These reasons and more are exactly why so many people across the country need help to navigate through all the confusing information to accomplish what is best for them, the consumer not the lender. You probably could use some help right now.

It's important to recognize the systemic factors that contribute to the cycle of debt and to advocate for reforms that promote fair and responsible lending practices. Additionally, individuals should take proactive steps to manage their finances, seek assistance when needed, and advocate for their rights as consumers.

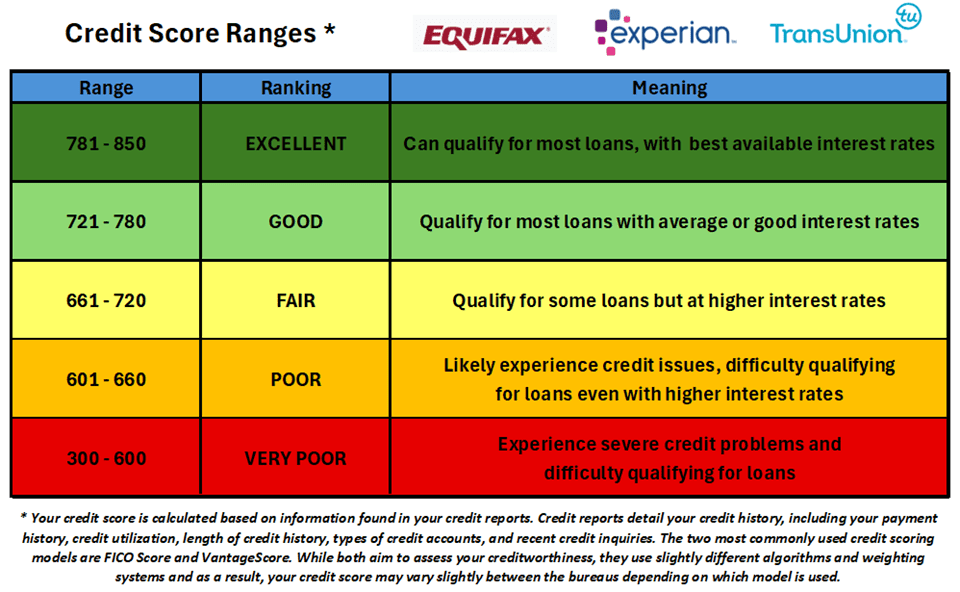

Score Ranges

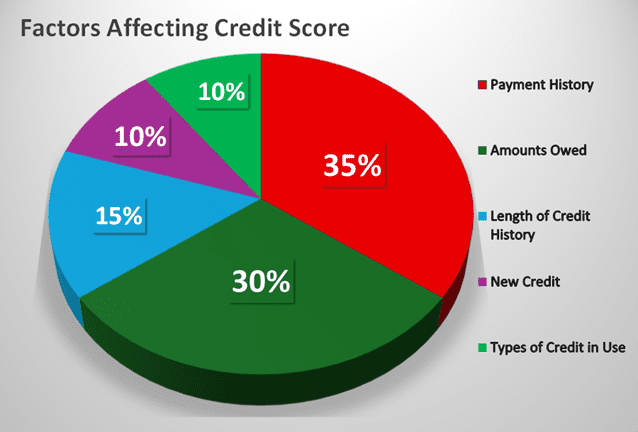

Factors Affecting Score